The Renewable Fuel Standard (RFS) landscape is on the move again—and this time, it’s big news. On July 8, 2025, President Trump signed the “One Big Beautiful Bill Act,” which includes a two-year extension of the Section 45Z Clean Fuel Production Credit, now set to run through 2029. At RINSTAR, we’ve been closely following both the evolution of this credit and the ongoing backlog of Small Refinery Exemptions (SREs).

Official White House Photo by Molly Riley

45Z Clean Fuel Credit Extended to 2029

In a major win for the biofuels industry, the recently signed “One Big Beautiful Bill Act” extends the 45Z Clean Fuel Production Credit for an additional two years, pushing its expiration from 2027 to December 31, 2029. Originally introduced under the Inflation Reduction Act, the 45Z credit rewards fuel producers based on the carbon intensity (CI) of their products, providing greater incentives for low and negative CI fuel pathways.

Highlights:

- Two-year extension of 45Z through 2029

- Reinstated credit for small biodiesel producers

- Carve-out for manure-based fuels, incentivizing ultra-low or negative CI production

This extension offers much-needed investment certainty for renewable fuel producers. With a longer runway, developers in sectors like renewable diesel, sustainable aviation fuel (SAF), and renewable natural gas (RNG) can better plan, finance, and scale projects. The added emphasis on manure-based feedstocks—such as dairy and swine waste—opens up new opportunities for producers.

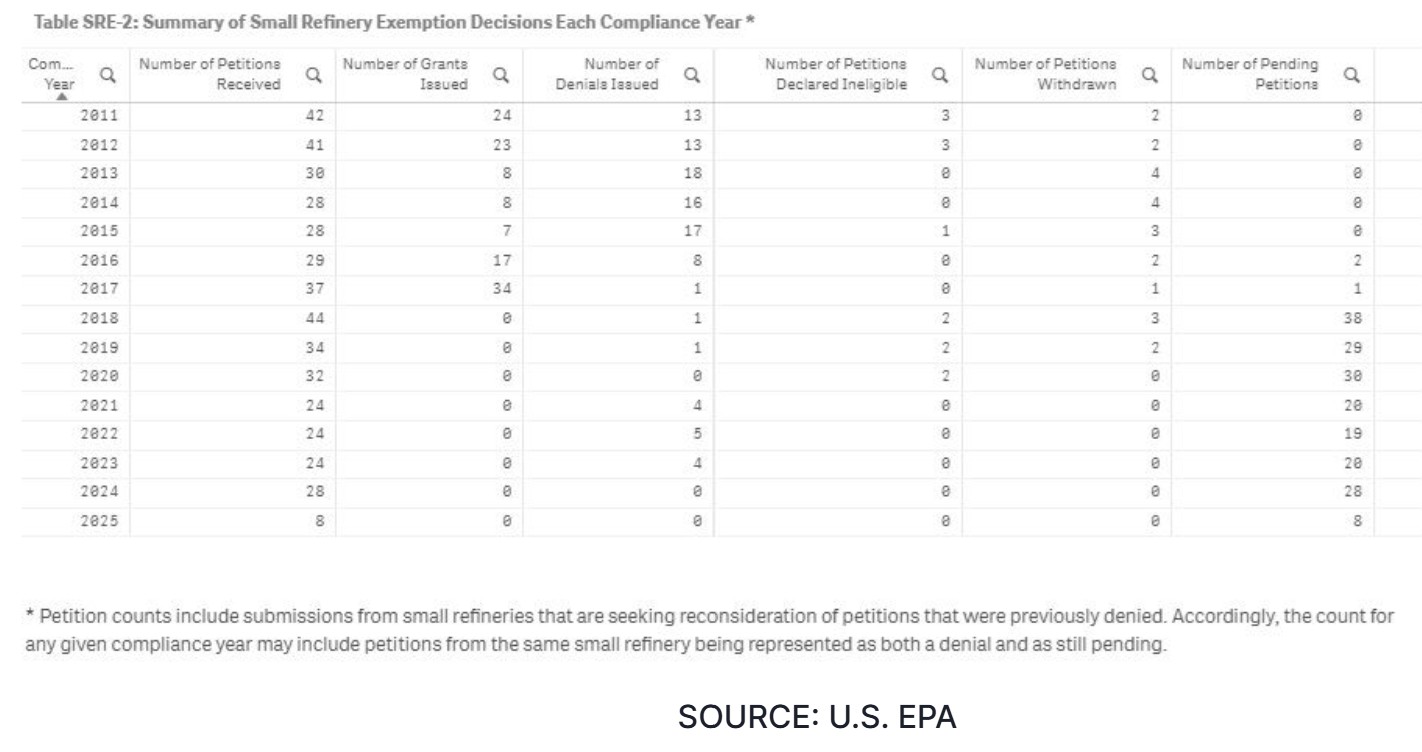

195 SRE Petitions Now Pending Under the RFS

While the recent extension of the Section 45Z Clean Fuel Production Credit offers a much-needed boost to the renewable fuels industry, compliance concerns under the Renewable Fuel Standard (RFS) continue to escalate. According to the U.S. Energy Information Administration, six new Small Refinery Exemption (SRE) petitions were filed in July 2025, bringing the total number of pending requests to a record-breaking 195. These exemptions allow small refineries processing fewer than 75,000 barrels per day to seek relief from RFS obligations by citing economic hardship. If approved, SREs exempt refineries from purchasing Renewable Identification Numbers (RINs), a move that can significantly reduce demand in the RIN market.

The growing backlog of SRE petitions introduces considerable uncertainty into an already complex regulatory environment. Market participants face increased volatility in RIN pricing and forecasting as they await EPA decisions, which are often delayed and lack transparency. A sudden wave of approved exemptions could saturate the market with unused RINs, driving prices down and potentially discouraging renewable fuel blending. As producers and obligated parties navigate these dual dynamics—strong policy incentives paired with uneven compliance enforcement—the need for strategic planning and robust RIN management tools has never been greater.

How RINSTAR Can Help

At RINSTAR, we’ve supported clients through more than 15 years of RFS compliance challenges. Our platform simplifies RIN tracking, inventory management, and regulatory reporting—giving you the tools to stay ahead in a volatile market.

👉 Learn more about how RINSTAR supports RFS compliance

Stay Informed

This is just the beginning of what could be a transformative period for the renewable fuels industry. Subscribe to our newsletter and follow our blog for more updates on:

- 45Z tax credit implementation

- EPA decisions on pending SRE petitions

- Carbon intensity trends and GREET modeling updates

- Renewable fuel tax and compliance strategies

Have questions about how these changes affect your business?

Contact us at services@cfch.com or schedule a personalized RINSTAR demo.