Here at RINSTAR, we’ve been closely following the “Half RIN” debate because of its impacts across the market offering advantages for some obligated parties while creating new compliance considerations for others. Half RIN aka RIN Haircut is the proposed lowering of the RIN value to 50% for biofuel produced domestically with foreign feedstock or imported biofuel. First introduced in the EPA’s June rulemaking, we have seen this proposal supported by many in the industry. Below, we’ve prepared a clear, practical breakdown of what it could mean for the RFS market just in time for a read before the holiday break.

So what is exactly being proposed?

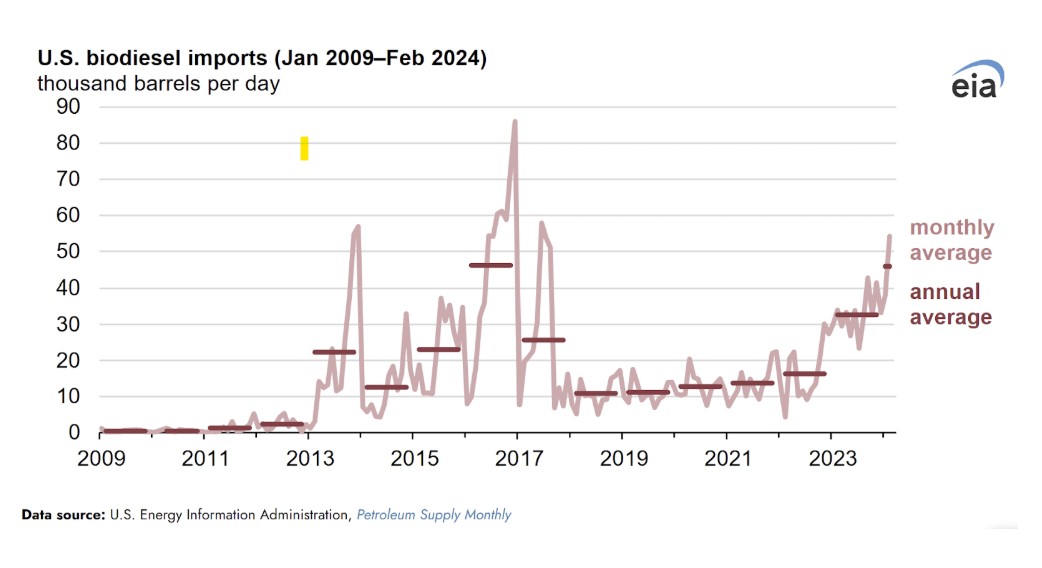

As noted earlier, in its June rulemaking the EPA proposed reducing the RIN value to 50% for domestically produced biofuel made with foreign feedstock, as well as for imported biofuel. This “half RIN” proposal would significantly alter the treatment of imported products under the RFS, with far-reaching implications for how biomass-based diesel is produced to meet the expanded RVOs and how feedstocks are sourced to satisfy the mandate.

In addition, the EPA proposed lowering the D4 RIN equivalence value for non-ester renewable diesel from 1.7 to 1.6 RINs per gallon. Because nearly all renewable diesel is produced through the HEFA process, this policy shift would place FAME biodiesel (currently generating 1.5 RINs per physical gallon) on a more level footing with renewable diesel. Under the half-RIN framework, domestically produced renewable diesel made from imported feedstock, as well as imported renewable diesel, would effectively receive only 80 cents per gallon in RIN value.

Successful Farming provided an excellent breakdown of the entire proposed RVO back in November.

When will we see the final ruling?

On December 8, the U.S. Court of Appeals for the D.C. Circuit ordered the EPA to provide a status update on its proposal to set the 2026 RFS RVOs. The EPA is required to file the update with the court within seven days.

The order stems from ongoing litigation brought by HF Sinclair Refining & Marketing LLC, HF Sinclair Parco Refining LLC, and Alon Refining Krotz Springs Inc. In its directive, the court instructed the EPA to submit a brief status report outlining the agency’s progress toward finalizing and promulgating the 2026 RVOs, which will determine the expiration date of the 2024 RINs at issue in the case. Where practicable, the EPA is also directed to provide an estimated timeline for issuing the 2026 RVOs which would include the half RIN final ruling.

However, some recent reporting indicates that the implementation of the half-RIN portion of the proposal could be delayed, shifting its effective date from January 1, 2026 to sometime in 2027 or 2028. In addition, there has also been discussion of revising the RFS definition of a “foreign country” from any non-U.S. nation to countries outside the North American region (potentially including Canada and Mexico) mirroring the approach used under the 45Z clean fuel tax credit.

What are people saying?

“This is a very big deal,” said Fred Ghatala, president of Advanced Biofuels Canada, “The U.S. is the largest export market for Canadian canola.”

“This rule, as currently drafted, could threaten continued investment, limit consumer access to innovative American-made fuels, and artificially drive up prices,” said Michael McAdams, President of ABFA. “But there’s still time to course-correct. The EPA has an opportunity to make smart, targeted adjustments that protect consumers and support continued industry growth.”

Senator Chuck Grassley (R-Iowa), a farmer and member of the Senate Agriculture Committee, along with more than 45 colleagues from both the Senate and House urged the EPA to finalize its rule addressing imported RINs and to maintain the proposed volume requirements. In their bipartisan and bicameral letter to EPA Administrator Lee Zeldin, the lawmakers emphasized that these actions were critical to ensuring the RFS continues to bolster U.S. energy security while supporting American farmers and domestic renewable fuel producers. “At a time when many farmers are struggling to break even, all federal biofuels policies should prioritize domestic agriculture and biofuel production, not foreign fuels made from foreign feedstocks. Additionally, while farmers face the uncertainty of foreign market demand, the Import RIN reduction would provide essential support for the farm economy so farmers could sell more products domestically,” the members said.

A new economic analysis concluded that the EPA’s proposal to allocate 50% of RIN credits to imported biofuels and biofuels produced from imported feedstocks (relative to domestically sourced fuels) would bolster U.S. soybean markets while maintaining flexibility in biomass-based diesel supply. The study, funded by the United Soybean Board and conducted by World Agricultural Economic and Environmental Services (WAEES), assessed impacts on feedstock demand, farmer income, and commodity prices across multiple potential outcomes for the EPA’s proposed 2026–2027 Renewable Fuel Standard volume requirements. “Soybean farmers support strong biomass-based diesel markets,” said ASA President Caleb Ragland and Kentucky farmer. “This study confirms that when policy values domestic feedstocks, rural communities benefit. The half RIN proposal still gives biofuel producers flexibility, but it keeps American soybeans competitive and keeps more value here at home.”

Stay Informed

As the EPA works toward finalizing the 2026 RVOs, the debate over the half-RIN proposal underscores just how consequential these decisions will be for fuel producers, obligated parties, and feedstock suppliers alike. With potential delays in implementation, evolving definitions of foreign feedstocks, and clear signals from both industry leaders and lawmakers, the final rule remains very much in flux. What is clear, however, is that any change to RIN valuation will reshape compliance strategies, investment decisions, and market dynamics across the RFS landscape.

To stay ahead, subscribe to our newsletter and follow the RINSTAR blog for timely insights on:

- EPA rulemakings and court decisions affecting RIN valuation

- Changes to RVOs and RIN expiration timelines

- Policy proposals impacting imported fuels and feedstock sourcing

- Compliance strategies amid evolving RFS requirements

Have questions about how the half-RIN proposal or upcoming RVO decisions could impact your operations?

📩 Reach out to us at services@cfch.com or schedule a personalized RINSTAR demo to see how we help simplify compliance in a changing regulatory environment.