Aviation is often considered one of the hardest industries to decarbonize. While cars and trucks can transition to electric power, aircraft still rely on extremely energy-dense liquid fuels to stay aloft. Sustainable Aviation Fuel (SAF), a low-carbon alternative to conventional jet fuel, can reduce lifecycle greenhouse gas emissions by up to 80% or more. The technology exists, the demand is growing, and airlines are eager to adopt it. The big question is whether the Renewable Fuel Standard (RFS) can help SAF scale quickly enough to meet the aviation sector’s massive fuel needs. At RINSTAR, we track these emerging pathways and their impact on the RFS and the renewable energy landscape.

The Big Goal: Closing the SAF Supply Gap

The U.S. has made its expectations clear through the SAF Grand Challenge, setting ambitious production goals:

- 3 billion gallons of domestic SAF annually by 2030

- 35 billion gallons per year by 2050, which would be enough to meet the nation’s entire jet fuel demand

At the moment, SAF production represents only a small fraction of total jet fuel usage. Reaching these targets will require significant expansion, long-term investment, and strong policy support to move the industry from “promising” to “fully scaled.”

How SAF Fits Into the RFS

The Renewable Fuel Standard requires renewable fuels to replace or reduce petroleum use in transportation, and SAF fully qualifies under this framework. SAF can generate Renewable Identification Numbers (RINs), which play a major role in helping close the cost gap between SAF and conventional jet fuel. Depending on its production pathway and emissions profile, SAF may fall under several RIN categories:

- D4 (Biomass-Based Diesel) and D5 (Advanced Biofuel): Common for current HEFA-based SAF made from fats, oils, and greases.

- D3 (Cellulosic Biofuel): The highest-value RIN category, supporting next-generation pathways such as

cellulosic SAF and Power-to-Liquids (PtL).

Because SAF can cost two to five times more than petroleum-based jet fuel, the value of these RINs is essential in making production economically viable.

The Headwinds: What’s Holding SAF Back?

Even with strong policy momentum and growing interest from airlines, SAF still faces several significant challenges:

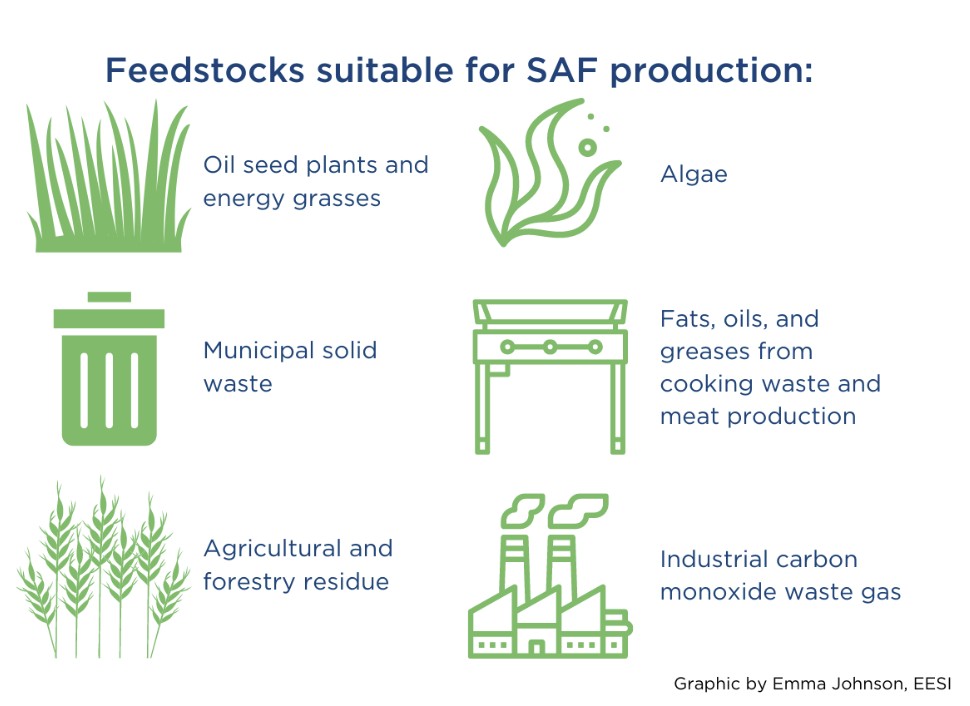

- Feedstock Costs and Competition

The most common SAF feedstocks (such as used cooking oil and waste fats) are limited in supply.

SAF producers must compete with renewable diesel producers for these same materials, which

drives up prices and constrains production potential. - Infrastructure Limitations

Although SAF is fully compatible with today’s aircraft, the distribution system isn’t yet built

for large-scale deployment. Most SAF must be blended with conventional jet fuel at existing terminals,

and expanding the infrastructure needed to supply major airports is both costly and time-intensive. - Technology Maturity

While several SAF production pathways have been approved, many of the next-generation technologies

needed to meet long-term volume goals are still under development. In addition, SAF is currently

limited to a maximum 50% blend with conventional jet fuel, though efforts to certify 100% SAF are ongoing.

The Tailwinds: Policies Helping SAF Grow

To help accelerate SAF growth, the U.S. government has introduced several new incentives to complement the RFS.

The Inflation Reduction Act added two key tax credits: the Section 40B SAF Tax Credit and the Section 45Z Clean Fuels Production Tax Credit. Both credits reward fuels that achieve greater emissions reductions, making SAF more financially appealing for producers and investors.

In addition, the SAF Grand Challenge brings multiple federal agencies together to coordinate research efforts, infrastructure investment, and policy support all with the goal of speeding up SAF deployment.

Taken together, these incentives significantly improve the economics of building and operating large-scale SAF production facilities.

The RFS provides the structure and RIN value needed to drive early momentum, while the IRA tax credits deliver the financial lift required to bring new SAF projects online. As next-generation technologies continue to mature, SAF is steadily moving from a niche solution to aviation’s most promising path toward net-zero.

The journey to 35 billion gallons won’t be simple, but the momentum is undeniable. With policy support, industry innovation, and investment all aligning, the SAF market is finally moving from potential to progress.

Next Steps with RINSTAR

SAF and the renewable fuels sector as a whole continues to evolve, having the right compliance tools becomes essential. RINSTAR helps make navigating the RFS straightforward and reliable, giving your team clarity at every step.

- Track RINs with ease

- Streamline compliance and reporting

- Stay ahead of shifting policies and updates

📩 Have questions? Reach out anytime at services@cfch.com, or schedule a demo to see how RINSTAR can support your compliance journey.