In the world of the Renewable Fuel Standard (RFS), preparation is the best protection. Whether you’re a producer, importer, or obligated party, annual attest engagements and EPA-mandated reviews are more than just routine, they’re essential to maintaining the integrity of your program.

With RINSTAR by your side, staying organized and audit-ready becomes much easier. This guide outlines what auditors typically look for, highlights common trouble spots, and shares practical tips to help your team stay confident and compliant all year long.

Understanding RFS Audits

Under 40 CFR §80.1464 renewable fuel producers, importers, exporters, and obligated parties are required to complete annual attest engagements. These third-party audits, conducted by a Certified Public Accountant (CPA) or Certified Internal Auditor (CIA), ensure that all data reported to the EPA accurately reflects your operations.

For many companies, these attestations serve as the ultimate check on recordkeeping, compliance accuracy, and data consistency. Having an organized compliance system in place can make all the difference between a smooth review and a lengthy remediation process.

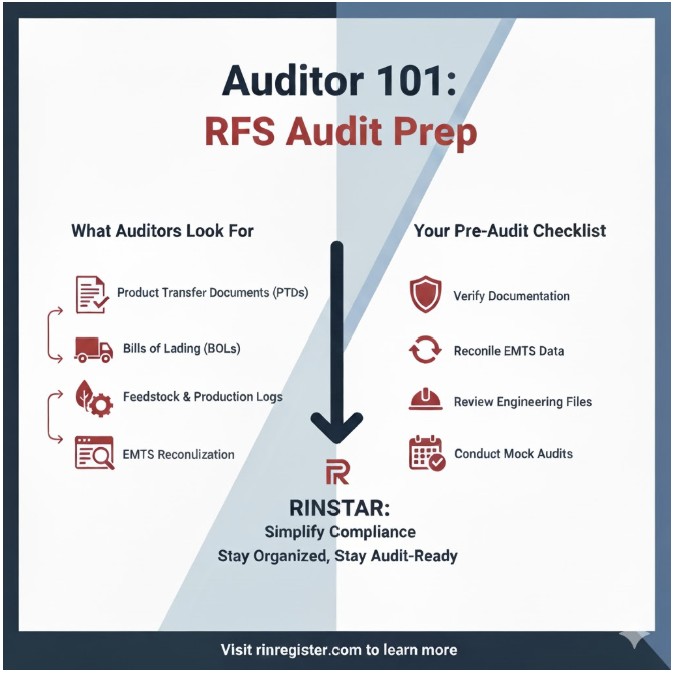

What Auditors Typically Focus On

1. Product Transfer Documents (PTDs)

PTDs provide the official record for renewable fuel and separated RIN transactions. Auditors will verify that each PTD:

- Accurately matches its corresponding EMTS transaction

- Contains all EPA-required details (such as RIN type, D-code, quantity, and transaction date)

- Is properly stored and easily retrievable for the required retention period

Tip: Keep all PTDs linked directly to their transaction record for faster cross-reference.

2. Bills of Lading (BOLs)

Auditors review Bills of Lading (BOLs) to confirm physical fuel movements and ensure that reported EMTS volumes match actual shipments. They typically compare:

- BOL dates and volumes with corresponding PTDs

- Supplier and customer details for consistency

- Any duplicate or missing entries across logistics systems

3. Feedstock and Production Logs

For producers, feedstock documentation is vital. Auditors will check that:

- Feedstock types match the registered pathway under 40 CFR §80.1450

- Quantities and sourcing align with RIN generation volumes

- Any co-products or production adjustments are clearly documented

Common weak spot: Missing or incomplete daily production logs and missing signatures on verification forms.

4. EMTS Reconciliation

Auditors cross-check RIN transactions between EMTS and your internal ledgers to ensure accuracy. They verify that:

- Generated, transferred, and retired RINs reconcile precisely

- Every EMTS transaction is supported by the appropriate documentation (PTD, invoice, etc.)

- No “stranded” RINs are left unaccounted for

5. Attest Engagement Records

Auditors will also look at past attestation results to confirm that any issues previously identified have been resolved. To make this process smoother, we recommend keeping copies of all correspondence and corrective action records in a company archive and ensuring this information is easy to access for both current and future RCOs.

Common Weak Spots Auditors Identify

Even well-organized facilities can stumble on details. Some of the most frequent issues our clients face are:

- Missing, inconsistent, or inaccurate PTD and BOL records

- Outdated or incomplete engineering review documentation

- Errors in EMTS submissions

- For example; wrong D-code, date of transfer, or RIN quantity

- Poor labeling or disorganized supporting files

These are small mistakes but under an EPA review, they can lead to time-consuming follow-ups or remedial action notices.

Pre-Audit Preparation Checklist

Here’s a simple checklist to keep your RFS compliance team ready for any review:

- Verify documentation completeness – Ensure every RIN transaction has a PTD, invoice, and shipment record.

- Reconcile EMTS data – Match every record against your internal inventory.

- Review engineering and registration files – Confirm that your facility registration is current and accurately reflects operations yearly.

- Check version control – Maintain clear document naming and dated revisions.

- Centralize audit materials – Store all compliance reports, attest engagement summaries, and transaction data in one accessible location.

- Conduct internal mock audits – Quarterly internal reviews help identify discrepancies early.

How RINSTAR Helps Simplify Audit Preparation

RINSTAR’s compliance platform automates much of the heavy lifting with features like file uploads, PTD generation, and real-time EMTS reconciliation. We keep your records organized, consistent, and audit-ready while ensuring your documentation aligns with every requirement, so you can focus on operations, not audits.

📩 Ready to simplify your next audit?

Contact us at services@cfch.com or visit rinregister.com to schedule a personalized RINSTAR demo.